Navigating the evolving A.I. terrain is like trying to find your way through a labyrinth. And to complicate things, there's much media ado about A.I. that you wonder, as a finance leader, if you're missing out on something.

Take the latest news for example. Unlike its predecessor, the newest version of ChatGPT-4 absolutely aced the Certified Public Accountant (CPA) exam with a score of 85%. This impressive feat highlights the potential of generative AI technology for the accounting and audit fields.

And tax professionals are taking notice; 50% of tax and accounting firms surveyed in the Thomson Reuters Institute's ChatGPT and Generative AI within Accounting Firms and Corporate Tax Departments report are already using generative AI on a "wide-scale basis", or are planning to use it "within the next 6 months".

Generative AI is a term referring to any tool that utilises machine learning algorithms, alongside natural language processing (NLP) and natural language generation (NLG), to generate human-like text, images, and videos and respond intelligently to user input.

Famous examples of generative AI tools include ChatGPT, Midjourney, Microsoft Bing etc. With their ability to generate human-like text and respond intelligently to user input, generative AI can facilitate communication and knowledge sharing among teams. This ensures that ideas are shared and understood by everyone involved, regardless of their native language.

By incorporating generative AI into collaboration platforms, finance professionals can overcome language barriers, enhance knowledge sharing, and foster a more inclusive work environment.

3 Ways Generative AI Can Enhance Finance Processes

1. Data Analysis and Insights

Using ChatGPT for data analysis; Source: Mohita Narang

Generative AI can help finance leaders speed up decision making by getting access to quick insights. By leveraging AI's NLP capabilities, AI-enabled platforms can enable users to interact with financial data using natural language, reducing the need to navigate complex reports or spreadsheets. Users can simply ask questions like, "What are our top-selling products this quarter?" or "How much cash do we have on hand?" to obtain real-time insights in a conversational format.

These AI-powered platforms are capable of generating customised financial reports and dashboards based on specific requirements, offering users the flexibility to access the information they need in a tailored format. By providing real-time insights and data visualizations, generative AI streamlines the analysis of financial data, allowing finance professionals to make informed decisions that drive company performance.

Thus, thanks to generative AI, your finance professionals are better equipped than ever to examine financial data quickly and effectively. The ability to access custom reports and dashboards, interact in natural language, and gain real-time insights improves the speed and accuracy of data analysis, empowering finance professionals to make deft choices that have a positive financial impact on their enterprises.

2. Streamlining Communication and Knowledge Sharing

Using ChatGPT for language translation; Source: The How To Cow

Generative AI can play a crucial role in facilitating seamless communication among finance professionals, enabling effective collaboration across language barriers. With real-time language translation capabilities, it enables team members to communicate and collaborate regardless of their native language. This ensures that ideas, insights, and information are shared and understood by everyone involved, promoting a more inclusive work environment.

Additionally, generative AI models like ChatGPT provide the ability to summarise and comprehend financial discussions, enabling team members to convey key information concisely. Some of the most popular collaboration platforms today, such as Microsoft Teams, are already incorporating generative AI to enhance the user experience of their platforms in this way.

Use The Power Of AI To Focus On What Matters Most In Every Meeting. Source: Microsoft

By incorporating the ChatGPT API, organisations can even create chatbots that assist with customer inquiries, providing 24/7 availability and prompt response times. These chatbots can efficiently handle customer queries and support the overall customer experience.

Additionally, generative AI promotes cooperation among financial experts by offering AI-driven insights that inspire debate and cooperation. ChatGPT provides insightful information by spotting patterns and trends in financial data, which encourages team members to collaborate on projects and generate fresh ideas. The AI-generated insights serve as a catalyst for fruitful conversations, enabling financial professionals to take use of their combined experience and spur innovation in their industry.

3. Automation of Financial Tasks

%20(1).png?width=1000&height=773&name=copilot-checklist%20(1)%20(1).png) Co-pilot (Generative AI application) embedded in Microsoft Dynamics 365 Business Central; Source: Microsoft

Co-pilot (Generative AI application) embedded in Microsoft Dynamics 365 Business Central; Source: Microsoft

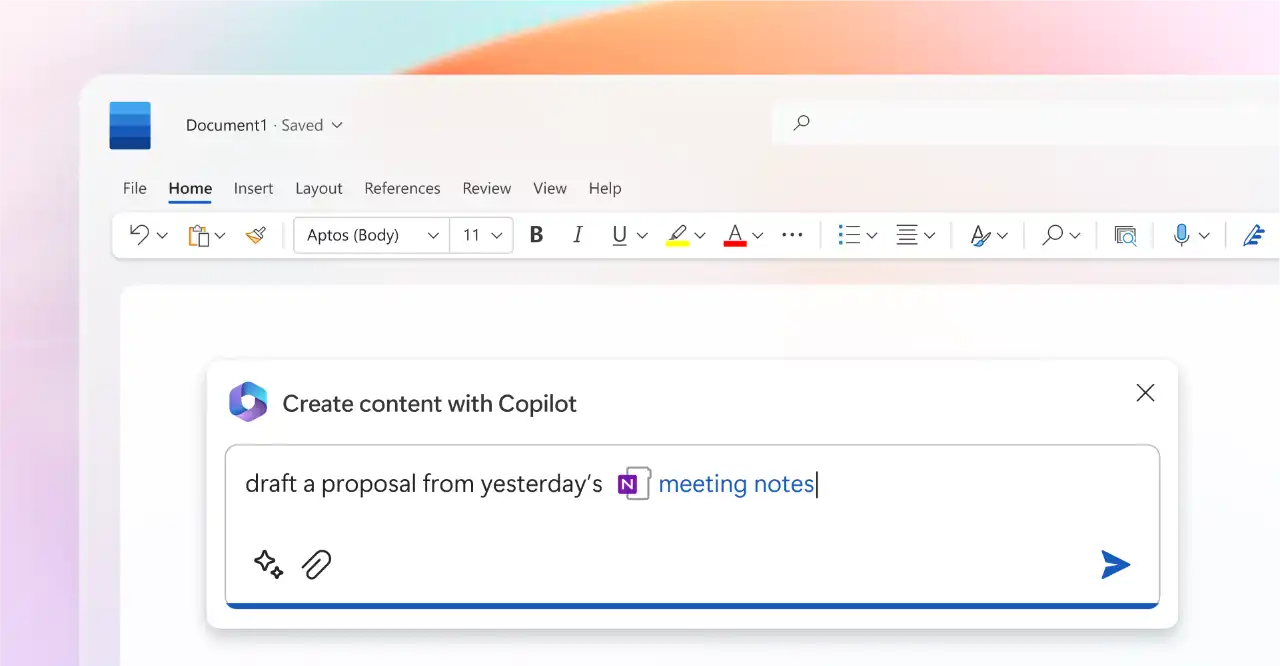

One of the best use cases for generative AI is the automation of routine tasks, such as with Microsoft 365 Copilot in applications such as Microsoft Dynamics 365 Business Central. Designed to integrate the vast capabilities of ChatGPT into Microsoft 365, Copilot is designed to boost employee activity by automating routine tasks such as generating first drafts, composing emails, and utilising the full spectrum of commands available in the productivity suite.

Find Out How You Can Leverage Next-generation AI In Your Business With Microsoft 365 Copilot.

This can also be applied to routine financial tasks, liberating valuable time for finance professionals to focus on more strategic and value-added activities. Generative AI excels in generating digestible summaries of documents and policies, as well as presenting large amounts of information in an organised manner for reporting purposes.

With the ability to distill complex information into concise and structured summaries, generative AI enhances the efficiency of financial reporting and facilitates effective communication with stakeholders.

This capability enables finance professionals to present key insights and findings in a clear and accessible format, facilitating decision-making and fostering collaboration across the organization.

Real-World Examples of Generative AI in Finance

To better understand the practical applications of generative AI in finance collaboration, let's explore some real-world examples.

Case Study: Samsonite Packs AI Into Financial Reporting

Samsonite International S.A. is a renowned global travel luggage company, with a rich history spanning more than a century. Researching and examining disclosures in financial reports made by peers and competitors presented difficulties for the business.

Downloading reports and looking up keywords manually took a lot of time and was ineffective. The business was also required to modify its reporting tactics to account for the effects of the COVID-19 pandemic, and the changing market conditions.

Samsonite adopted Sentieo, an AI-powered solution connected with their Workiva financial reporting platform, to address these issues. Sentieo's sophisticated search feature made it easy for Jeff Brown, the Manager of Financial Reporting at Samsonite, to quickly find keywords and related terms. This greatly sped up the investigation and analysis phase.

The integration of AI technologies in financial reporting at Samsonite yielded substantial benefits. By leveraging Sentieo, Samsonite experienced faster and more comprehensive access to relevant information, enabling professionals to make informed decisions and promptly discover new risk factors. The use of AI-powered search platforms enhanced collaboration and confidence in disclosures, resulting in improved relationships with auditors.

The success of AI applications in optimising financial reporting processes at Samsonite showcases the potential of generative AI, such as ChatGPT, to further enhance financial reporting capabilities. Generative AI can automate report generation, provide real-time analysis, and present information in an organized manner. These capabilities contribute to increased efficiency, accuracy, and decision-making in financial reporting, empowering businesses like Samsonite to gain deeper insights and achieve greater operational effectiveness.

Case Study: Marks & Spencer Leverages Power BI To Drive Powerful Insights That Promote Growth

Marks & Spencer, a well-known retail company based in the United Kingdom, required an extensive data analytics solution to support business growth and improve decision-making. They revolutionised their approach to data analysis by deploying Microsoft Power BI, enabling them to derive valuable insights and gain a competitive edge in the market.

With Power BI, Marks & Spencer streamlined their data visualization and reporting capabilities. The intuitive interface and interactive dashboards provided their teams with a user-friendly platform to explore and interpret complex data sets effortlessly. From sales performance to customer behavior analysis, Power BI empowered Marks & Spencer's decision-makers with real-time access to critical information, enabling them to make data-driven decisions quickly and confidently.

Marks & Spencer was able to find practical insights through the use of Power BI's advanced analytics capabilities, which helped them optimise their business processes. The retail chain obtained a comprehensive understanding of their supply chain, inventory management, and sales patterns by utilising the robust features of Power BI. This enabled Mark & Spencer to spot inefficiencies, optimise resource allocation, and implement targeted strategies that would increase operational effectiveness and save costs.

Challenges in Implementing Generative AI In Finance

Overview of 10 ChatGPT's limitations; Source: Bernard Marr

Of course, as with any new technology, there are potential pitfalls to keep in mind. While generative AI can offer many benefits, there are also issues that need to be addressed when implementing it in finance collaboration. These should be carefully considered to ensure that the technology is used effectively and to its full potential.

One challenge is its dependence on your datasets and how you've 'trained' the tool. While it can analyse large amounts of data and provide valuable insights, its precision and accuracy is dependent on a) how it's set up -- did you get the right data professional to help? b) how clean your dataset is.

Generative AI has also been known to provide misleading information or lose track of context in conversations. So, it's crucial to approach it with a discerning eye and double-check its outputs for accuracy and relevance to the intended context.

Data security is another critical consideration. Feeding financial data into standalone generative AI solutions could pose a security risk, as financial data is often sensitive and confidential. Partnering with established business solutions, like Microsoft Dynamics 365 Business Central, that feature reliable and tested AI capabilities is the way to go to ensure the security and privacy of financial data.

Finance professionals should be aware of the limitations and consider the specific needs of their organization before relying solely on generative AI for critical financial tasks.

Generative AI Have The Potential To Transform Finance As We Know It

-1.jpg?width=1000&height=666&name=glenn-carstens-peters-npxXWgQ33ZQ-unsplash%20(1)-1.jpg)

The integration of generative AI, exemplified by ChatGPT, presents businesses with unprecedented opportunities to streamline collaboration and enhance financial processes. By harnessing the power of generative AI, CFOs and finance managers can revolutionise how their teams collaborate, optimises decision-making processes, and automates routine tasks.

Generative AI models can understand and summarise financial discussions, making it easier for team members to exchange information and insights efficiently. This enables finance professionals to communicate and collaborate effortlessly, leading to improved productivity and better decision-making

Moreover, generative AI holds the potential to automate routine financial tasks such as data entry and report generation, allowing finance professionals to focus on more complex and value-added activities such as strategic planning, financial analysis, and collaborating with stakeholders.

In summary, generative AI tools such as ChatGPT present exciting possibilities for the finance industry. By simplifying communication, providing valuable insights, and automating mundane tasks, finance professionals can collaborate more effectively, make informed decisions, and boost overall efficiency and productivity.

While Copilot and Teams Premium are examples of how Microsoft have acted quickly to incorporate generative AI technology into its productivity solutions, the software giant has always been at the forefront when it comes to collaborative solutions.

The cloud-based productivity suite Microsoft Office 365 is not only the prime example of this, but it's also where Microsoft's efforts to incorporate generative AI will be most likely to see results.

To find out more about how Office 365 can already enhance your employees' ability to collaborate with each other, click on the image below for our crash course into the suite.

%20(1).png?width=1000&height=666&name=data%20analysis%20w%20chatgpt%20(1)%20(1).png)