Many analysts expect the professional services market to reach $7063.87 billion in 2025. That’s a hefty increase from the $5428.45 billion expected in 2021, at a robust compound annual growth rate (CAGR) of 7 %.

The bad news is that your professional services firm will find it a tough challenge to tap into this market growth – yet it’s a challenge your business must beat if it’s to survive and thrive in the future.

To achieve this, most businesses establish a set of key performance indicators (KPIs). By monitoring common KPIs such as net profit margins and operational cash flow, you get the feedback you need to gauge your business's financial and operational health at any point in time.

Below are seven KPIs that are essential for your professional services firm to track, in order to generate next-level performance:

1. Billable Utilization Rate (BUR)

This KPI is critical for professional services firms like yours. Calculated based on a 2,000 hour-work year (or a 40-hour workweek), BUR tells you how well you’re maximising business opportunities and if you need to expand or contract your firm.

You can use BUR to gauge a team member or a firm’s activities. A high BUR indicates you may need to add team members or invest in new tools.

Use the KPI for performance management, resource planning, and pricing strategies. Although the industry average for early-stage professional services firms is 61%, you should ideally strive for a BUR of 75%.

You can calculate your BUR using this formula:

Billable utilization rate = 100% Hours Billed/ 2000

2. Annual Revenue per Billable Consultant

Changes in this KPI measures your consultants’ efficiency and the quality of their client engagements.

You can share it with your management to identify which clients best fit your professional services firm, which are a poor fit, and which are unprofitable.

The industry average is $165,000 for early-stage professional services firms.

You can calculate this KPI using this formula:

Annual Revenue per Billable Consultant = Total Annual Revenue/Number of Billable Consultants

Alternatively, you can use the following alternative formula to gauge the overall efficiency of your firm:

Annual Revenue per Employee = Total Annual Revenue/Number of Employees.

3. Annual Overhead per Billable Consultant

Your Annual Overhead per Billable Consultant reveals the baseline revenue needed per billable consultant to cover your professional services firm’s operating costs.

Especially important for startups where each new employee can impact overhead, this KPI helps you gauge operating cost, track firm efficiency, and determine if your costs are going up or down relative to growth.

To determine the effective billable output of your business, you can compare this KPI against your Annual Revenue per Billable Consultant.

You can calculate this KPI using this formula:

Annual Overhead per Billable Consultant = Total Annual Overhead /Number of Billable Consultants

4. Project Margin

This KPI sheds light on which of your teams perform best, which class of clients is more profitable, and margins are eroded by unexpected costs.

Maintaining project margins is vital for the future of your business. Low margins translate to less available funds going forward and limit your ability to invest in the future.

Keep your margins at 40% if possible. And review discounts for large and repeat customers. They could be pushing margins negative.

You can calculate your profit margins using this formula:

Project Margin = (Project Revenue — Project Cost)/Project Revenue

5. Project Overrun

Project overruns shrink the profitability of your professional services firm, and limit the possibility of new project launches.

Overruns can damage your business even if you charge by the hour. Either you charge customers more than quoted, which creates ill will unless the client agrees to the extra charge.

Or, your bulliable consultants stayed on the project longer than expected, eating into their training time or delaying their other customer engagements.

Track overruns closely, and determine why they occurred.

And you’ll also want to check to see whether your project cost estimation approach needs refining, as well as which of your teams regularly exceed billable estimates.

You can calculate project overruns using this formula:

Project Overrun = Budget Cost/Actual Cost

6. Churn Rate (CR)

This KPI is especially critical for professional services firms, which often rely on recurring business.

Usually calculated monthly, quarterly or annually, churn rate (CR) measures your customer turnover.

Retaining and cultivating relationships with your profitable customers is less costly than finding new ones.

In addition, lowering your CR by 5% boosts your profits by about 125%. So, you want to keep your CR low.

But be careful with this KPI, as it values all of your customers equally. And as you know, that’s not usually applicable in the real world.

For example, customers who are undertaking test runs and evaluating your services are not as valuable to your firm’s long-term fortunes as your long-standing customers.

If you have a high CR, determine why you lose your clients. Was it the result of unforced errors by your teams, or was it due to circumstances beyond their control?

For example, if one of your customers had to shut down because of the COVID-19 pandemic, that is obviously not a loss to your business you could have prevented either way.

You can calculate your CR using this formula:

CR= 100% x Customers Lost This Period / Total Customers at Period Onset

7. Day Sales Outstanding (DSO)

Your Day Sales Outstanding (DSO) represents the number of days from the time you start rendering services to the day you get paid.

You’ll want to keep this number low, as a high DSO means you’re providing services on credit and takes longer to collect payment.

That often results in low cash flow for your professional services firm, and boosts the risk of customers defaulting on your payments.

Automated billing functions can go a long way towards ensuring that your DSO stays as low as possible.

You can calculate DSO using this formula:

DSO = (Account Receivable/Total Revenue) x Number of Days

NetSuite SuiteProjects Makes Monitoring Your KPIs Easier

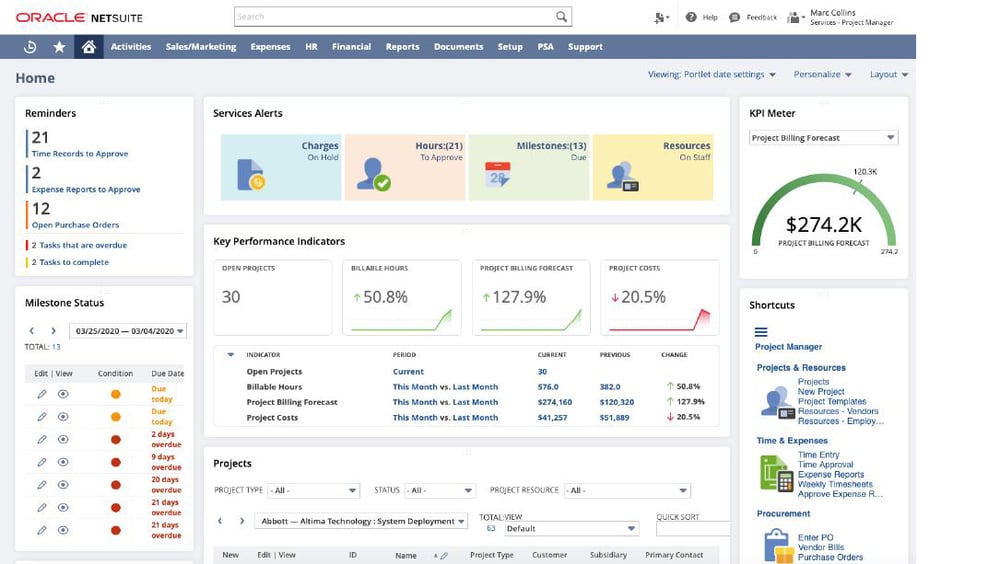

SuiteProjects provide dashboards that give you real-time access to your KPIs. Source: NetSuite

NetSuite SuiteProjects can automate the calculation of your critical KPIs, making it much easier for you to monitor them.

First introduced to Oracle NetSuite in the 2021 Release 1 update, SuiteProject is a professional services automation (PSA) solution that’s natively built on NetSuite.

When combined with NetSuite’s financial management features, NetSuite CRM, and SuitePeople, SuiteProjects provides a single comprehensive management platform for professional services firms like yours.

Apart from real-time reporting on your KPIs, SuiteProjects also comes with critical features such as time and expense management, billing project revenue, project accounting, and analytics amongst others.

With SuiteProjects, you can drive profitability in your professional services firm by streamlining operations, complete projects more quickly than ever, improve resource utilisation, and increase visibility across your business.

KPIs Help You Monitor How Effective Your Firm Is

Monitoring your KPIs effectively is key to boosting the performance of your professional services firm.

With the right set of KPIs, you will be able to tell how effectively your business is operating.

To make sure you choose the right set of KPIs, each KPI should provide a measurable value and a target that it should hit.

A PSA solution – such as NetSuite SuiteProjects – can help you establish and track the right KPIs for your business.

PSA solutions can also help you see how your KPIs are interacting, which is critical to making sound business decisions.

Recognising these interactions provides insights into how your professional services firm operates, helps you develop more focused objectives and goals, and helps boost the effectiveness and profitability of your firm.

More importantly, it will help you tap into the market growth that analysts predict will happen to the professional services sector in the near future.

To learn more about how ERP software - especially cloud ERP with in-built PSA solutions such as NetSuite SuiteProjects - can help you create value with data, click the image below to download our resource.