On 30 October 2024, AFON co-hosted 'Unravelling the Future of SAP Business One' Event with SAP at SAP's Singapore Office. The seminar is hosted mainly for our SAP Business One's customers, with the purpose of sharing the future of Business One, new AI system, and new B2B integrated payment solution.

Here are some of the key highlights of the seminar:

Future of Business One

Justin Ho, Head of SAP Business One - APJ & GC, assured attendees that Business One is not only here to stay but is also set to evolve. The vision is to enhance its system as the ERP solution for small and mid-sized businesses, providing flexible deployment options such as partner-managed cloud, a robust global business foundation, support for cloud extensions (SAP Business Technology Platform and SAP Build), and an exceptional user experience.

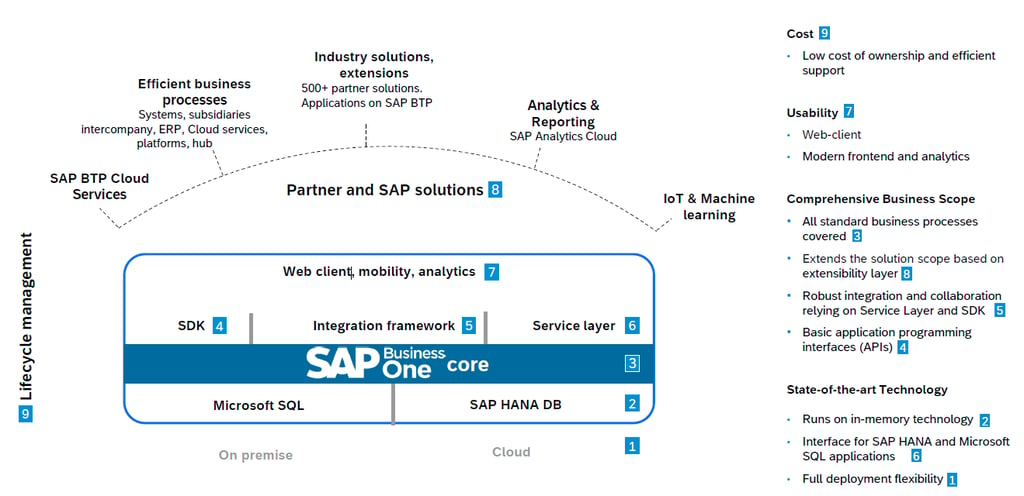

SAP Business One Solution Stack

SAP Business One grows with your business. Whether you're adding new users, expanding to new markets, or incorporating additional functionalities, the system effortlessly adapts to your evolving needs.

SAP Business One offers the adaptability to tailor the solution to align with your unique business processes, guaranteeing that you consistently have the appropriate tools readily available.

New AI System

Leonard Thum, General Manager of MTC Asia Pacific, shared about its newly developed AI system that can be integrated with Business One.

Business One Copilot

One of the features from their AI System is the Business One Copilot. It is an AI-powered productivity tool that allows you to search for specific information, generate content, and obtain insights. As such, you will be able to complete tasks more efficiently, enhance your productivity & skills, and improve your overall work experience.

New B2B Integrated Payment Solution

Charlotte Le Gargasson, Head of B2B Partnerships - Visa Commercial Solutions, Asia Pacific, introduced its Visa B2B Integrated Payments (VBIP).

Visa B2B Integrated Payments (VBIP)

Businesses are progressively looking for solutions that offer liquidity support, highlighting the increasing significance of having access to flexible working capital. The VBIP solution enables businesses to extend their payment terms by up to 55 days. This provides you with enhanced control over your capital, payments, and expenses.

Furthermore, you can make payments within Business One using Visa commercial cards, irrespective of whether the supplier accepts cards or not.

Q&A

Following the presentations, there was an engaging and interactive Q&A session led by Alythea Ho, AFON's Digital Marketing Manager. The Q&A session provided attendees with the opportunity to delve deeper into the topics shared during the seminar. The expert speakers addressed a variety of questions from the audience, offering further insights and clarifications on the future of Business One, the new AI system, and the B2B integrated payment solution.

The following summarised questions were answered in detailed by the speakers.

Future of Business One

- If SAP B1 is customised heavily with workflow and control, will it reflect in web client?

If SDK is used during the customisation or there are additional UDFs / UDTs that are non standard, these will need to be re-configured in Web Client. - Will the mainstream support for SAP Business One Release 10.0 be until December 31, 2026 as SAP website mentions? If so, should we wait for version 11 release for the version upgrade?

Yes, the latest support information will always be found on SAP’s website for support and maintenance. My advice is to stay updated with the current latest version, as the current guidance is that version 11 will be announced this quarter, but we have not confirmed the timeline. - Will SAP release their own version of Gen AI in Business One? Or only from third-party such as MTC?

SAP currently has no intention of releasing our own Gen AI in SAP Business One. Our recommendation is to work with our partner ecosystem (e.g. MTC) that has developed these Gen AI solutions. - If we do not upgrade to a newer version of Business One, are there any implications? E.g. Are customizations still possible? Able to adopt PEPPOL (e-invoicing network)?

As long as the licenses purchased are perpetual, you will still be able to use the SAP Business One application in the current form. However, there will be no upgrades, patches and hotfixes available for older, non-supported versions. In this example if there is an issue with the connection with PEPPOL that has been fixed through a hotfix, this may not be available to customers that are on our older versions. Customisations done by partner will still be allowed (to be discussed with partner).

New AI System

- Can the AI system be used if our Business One in installed in our office server?

Yes, the AI system demonstrated works with Business One client, regardless of deployment model of the server (i.e. on-premise or cloud-hosted). - Is the AI system able to help with issuing invoices to customers?

The existing use case supported is to automatically create supplier invoice in the system from PDF invoice received via email or upload, similarly, purchase order or sales order document can be automatically created. - Will there be any AI solution that can help with bank reconciliation?

It is being planned with productive release of our Business One Copilot. - Does the AI system work on any version of Business One?

Our AI Document Processing Service supports both SQL and HANA version of Business One, so will be the Business One Copilot once it is productively released.

B2B Integrated Payment Solution

- Do we need to have our own VISA commercial card from bank or from VBIP to adopt the payment solution?

Yes,

i) Where the company has a Visa commercial card, please let us know which bank and we will check to ensure that the particular bank / card has been included in the VBIP programme. The advantage of already having the Visa commercial card will speed up the process of coming onboard VBIP

ii) Otherwise, given Visa’s close relationship with our partner banks, please let us know which are the company’s preferred banks (in order of preference) and we will reach out to our partners to approach the company (please leave their contact information). The banks can kickstart the process of working with the company to evaluate issuing a Visa commercial card. - Can VBIP be used to pay overseas suppliers?

Yes,

i) For existing card-accepting suppliers overseas (and domestic), VBIP can already be used to pay to these suppliers at no charges to the sender of the payment (your company’s clients).

ii) For suppliers who do not accept cards, VBIP can be used to make payments domestically at 1.33%. We are working with customers to understand their needs on overseas supplier who do not accept cards to enhance VBIP for the popular currency corridors. - If we are paying to local/overseas suppliers in local currency or other currencies, are there any other costs incurred other than the 1.33% fee on transaction amount?

No,

i) For existing card-accepting suppliers both overseas and domestic, the 1.33% does not apply. Specifically for oversea payments, this will be subject to existing bank charges stipulated in your commercial card term & conditions with your bank.

ii) For suppliers who do not accept cards, only the 1.33% applies domestically. For overseas suppliers, we are working with customers to understand their needs on the popular currency corridors and the current prices they pay before we solutionise to ensure a compelling proposition.

We hope that this summary of the seminar has given you an informative peek into the future of Business One, the new AI system by MTC, and the B2B integrated payment solution by VISA.

For further enquiries, please do not hesitate to contact us.