As a cloud-hosted accounting software that’s similar to their own products and services, Xero is a popular financial management solution for FinTech startups.

It brings basic accounting and bookkeeping features to the table – such as invoicing, billing and cash flow tracking – that’s sufficient for the needs of FinTech firms like yours in the early days.

But once your FinTech firm begins growing in scale, you’d find that Xero might not be capable of supporting that growth despite being a cloud-based solution.

That’s because Xero is designed to support the financial management needs of small businesses in the early stages, with relatively simple business models.

But as FinTech firms like yours grow in scale, you’re likely to find that Xero lacks the features and functionalities to support your growing business without third-party integrations, which comes with its own problems such as the creation of business system hairballs.

At this stage, you might want to consider moving your FinTech firm away from Xero, and to a financial management solution with a more robust and comprehensive feature set.

Such as a true cloud ERP software like Oracle NetSuite, for example.

Here Are Four Ways That Cloud ERP Software Have Benefited FinTech Firms Like Yours.

Let’s find out how NetSuite compares to Xero, and how your FinTech firm can benefit from upgrading from the accounting software to the cloud ERP software. why it makes sense for your FinTech firm to upgrade from the cloud accounting software to the cloud ERP software at a certain point.

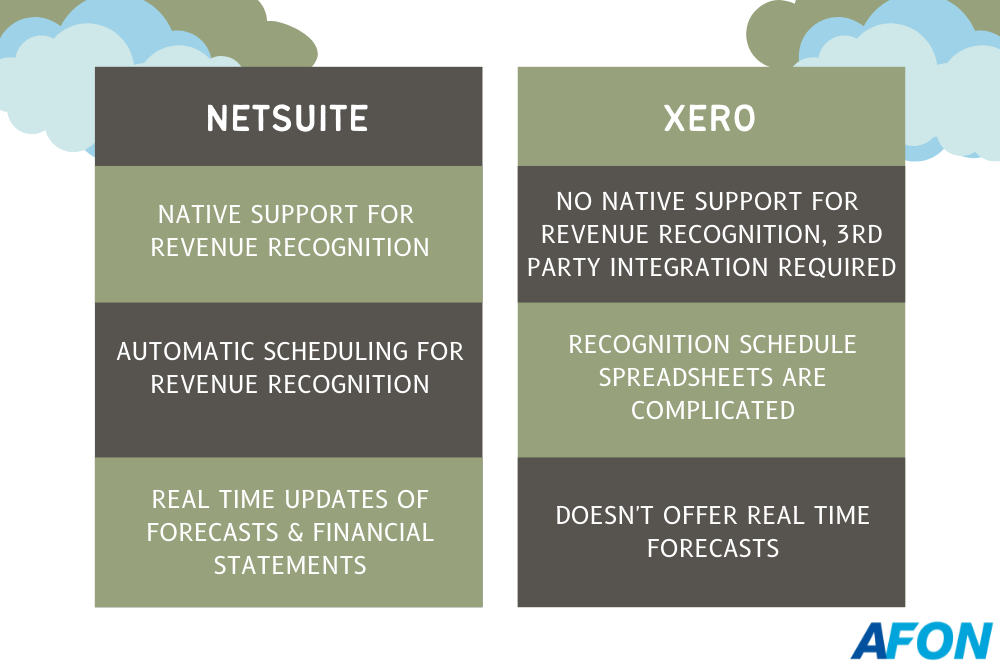

Built-in, Automated Revenue Recognition

FinTech firms like yours tend to handle multiple deliverables, such as services delivered over time, upgrades, and additional licenses for your products and services.

Because of this, revenue recognition is an especially important aspect of financial management for your business.

However, Xero does not offer revenue recognition as a core feature of its solution. To acquire that with the accounting software, you’d need to integrate it with a third-party application or add-on.

And even then, you’d have to use recognition schedule spreadsheets, which can be complicated and further hinder your revenue recognition efforts.

Upgrading to NetSuite, on the other hand, would provide your FinTech firm with native support for compliance with revenue recognition requirements. It also comes with automatic scheduling to ensure your business conducts revenue recognition on a regular basis.

In addition, carrying out revenue recognition in NetSuite also updates your forecasts and financial statements in real-time. This ensures your FinTech firm gets data-driven insights on demand, allowing you to make data-driven business decisions that leads to greater success for your business.

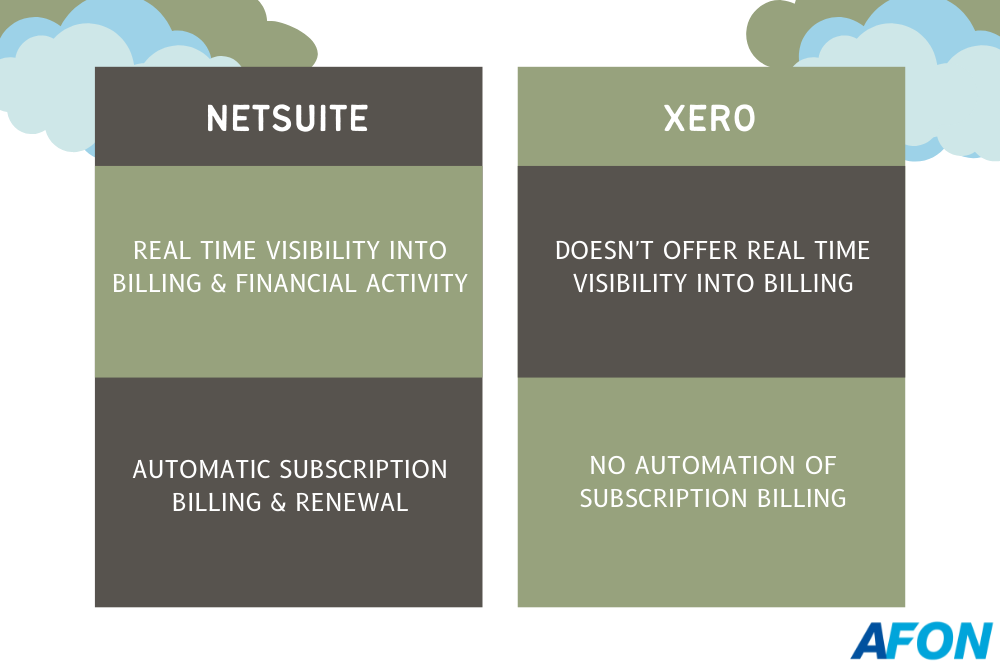

Automated, Real-time Billing

Having real-time visibility into your billing processes and financial activity is important for FinTech firms like yours, as it directly impacts the revenue and thus the profitability of your business.

You’ll get this real-time visibility with NetSuite, which provides transparency into your processes with features like consolidated invoicing, automated rating processes, and support for multiple price models.

In addition, NetSuite also automates the renewal of your subscriptions, which helps reduce manual oversight and retain your revenue. You can also schedule changes in your subscriptions, as well as set automatic pricing and discounting for specific customer types.

In contrast, Xero lacks either of these capabilities. As such, if you stick with the accounting software, your FinTech firm will have to handle both billing and subscription renewal manually, using spreadsheets which are liable to incur errors.

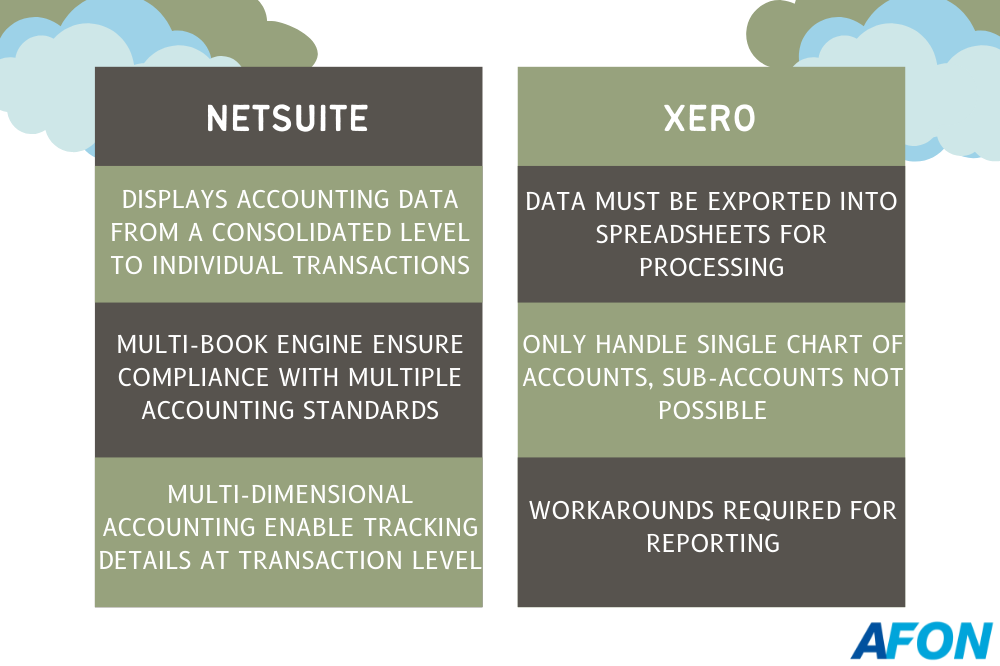

General Ledger (G/L) With Full Visibility And Drill-down

To support the growth of your FinTech firm, you need a financial management solution with a general ledger (G/L) that provides maximum visibility into the financial transactions carried out by your business.

More importantly, as your FinTech firm grows in scale and its business model subsequently becomes more complex than ever, the G/L must be capable of handling the increased complexity of these transactions.

NetSuite’s G/L makes this possible by displaying data about your FinTech firm’s financial transactions at all levels, from a consolidated top-down view of all financial activity, to drilling down to specific details in individual transactions.

It’s also flexible enough that you can customize it to best fit your FinTech firm’s specific business needs, reducing the time and effort needed for account reconciliation, period close and audit processes.

NetSuite also comes with a Multi-Book engine, which helps your FinTech firm comply with multiple accounting standards in the case of expansion to overseas territories with features such as expense amortisation, depreciation, profit & loss (P&L) allocations etc.

It’s also capable of multi-dimensional reporting, which lets you add tracking details at the transaction level, and removes the need for a complicated chart of accounts.

On the other hand, sticking with Xero for your FinTech firm means coping with an inflexible G/L which doesn’t allow you to drill down into the details of your business transactions as much as you might like.

Because it only offers a single chart of accounts which does not support sub-accounts, your FinTech firm might find it harder to navigate multiple accounting standards faced by subsidiaries established in other countries.

You could get around this with workarounds such as tracking categories, account names and account groups, but to glean more detailed insights from your FinTech firm’s financial data, you’d have no choice but to export it into spreadsheets for your finance personnel to process manually.

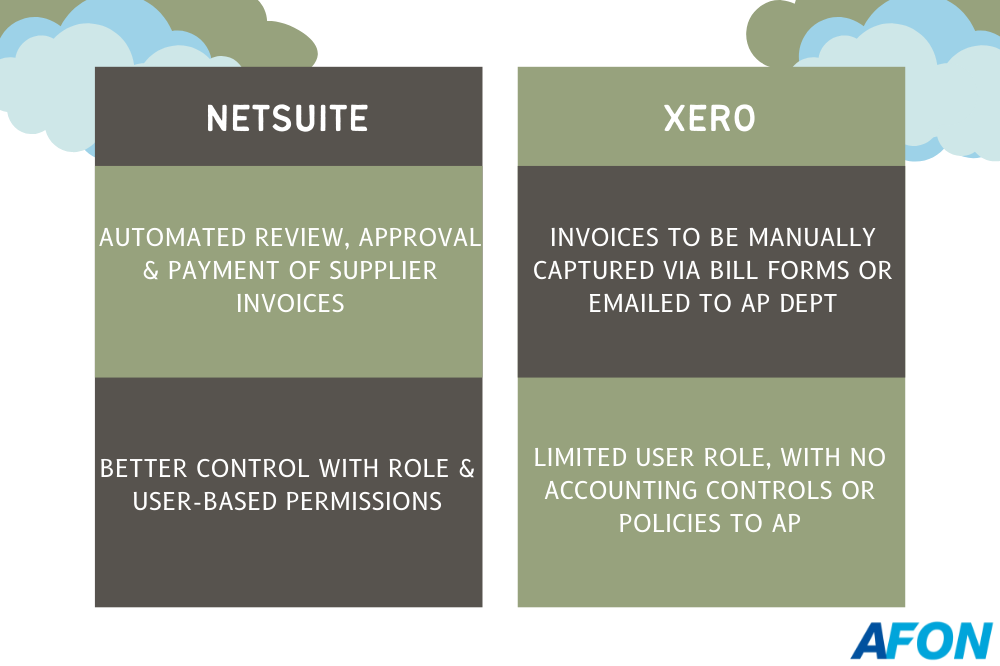

Automated Accounts Payable (AP) With Permissions

As a FinTech firm, your business would expect the same level of automation in its financial management solutions, as it provides with your own products and services.

NetSuite can achieve that with your AP processes, with its automation of the review, approval, and payment of supplier invoices.

It also allows the AP process to be configured to reduce the need for manual interventions. For example, your end users can automate discounting based on specific suppliers, or exception management when invoices fail to match purchase orders (PO), just to name a few.

NetSuite also combines its workflow engine with role-and user-based permissions, to ensure that accounting and governance controls and policies are complied with.

As for Xero, the accounting software has limited functionality when it comes to AP. To manage your supplier invoices, you’d need to capture them manually using either a bill form, or otherwise emailed to your AP department to do the same.

It also has limited user roles, and doesn’t provide accounting controls or policies that can be applied to AP. This means Xero cannot provide your FinTech firm with a controlled environment, or true segmentation of duties across the AP process.

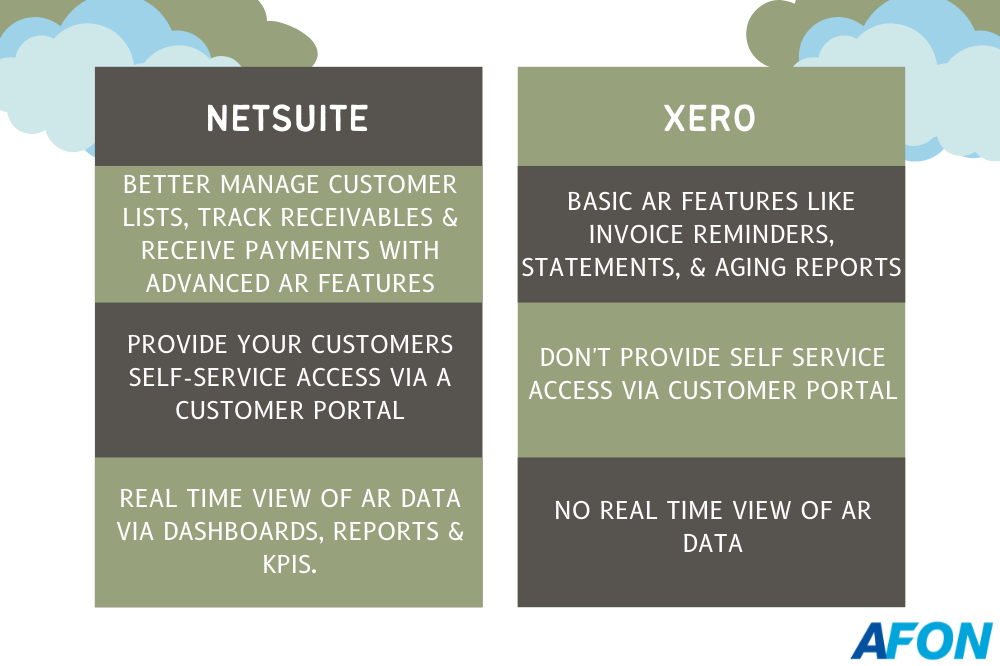

Advanced Accounts Receivable (AR) With Self-service And Real-time Visibility

Just as important as AP to your FinTech firm are your AR processes, along with the same expectations for automation.

And NetSuite delivers with advanced AR features, which allows you to manage your customer list, tracke your receivables, manage late payments from your customers, and receive payments without the need to enter detailed debits and credits.

As a fully-featured ERP software, NetSuite also makes it easier for your customers to make their payments to your FinTech firm for products and services rendered. Its self-service customer portal provides your customers with real-time access to POs, inventory levels and payment information, giving them instant insights on where they stand with your business.

Additionally, NetSuite also comes with configurable dashboards, reports and KPIs that give you a real-time view into your FinTech firm’s AR data. These include customer aging, invoice analyses, recurring invoices, deferred revenue, and exception reports that flag anomalies in your payments.

By contrast, Xero can offer only basic AR features, such as invoice reminders, statements, and aging reports. It offers nothing that can automate your AR processes like NetSuite, forcing you to carry them out manually.

FinTech Firms Should Upgrade From Xero To NetSuite To Support Their Business Growth

%20(1).jpg?width=1000&name=linkedin-sales-solutions-Jk3u514GJes-unsplash%20(1)%20(1).jpg)

From the comparison of the features above, we can see that FinTech firms like yours would be best served by transitioning from Xero to Oracle NetSuite.

That’s because the true cloud ERP software has a more robust set of financial features, and greater automation of financial processes, than the cloud accounting software could bring to the table.

Therefore, to support the future growth of your FinTech firm, it’s advisable that you upgrade your FinTech firm from a basic cloud accounting software like Xero, to a true cloud software with a more sophisticated and comprehensive set of financial management features like NetSuite.

But how do you know if your FinTech firm has truly outgrown Xero? To find out if that’s the case, click on the image below to learn more.