Note: This blog post was originally published in 2020. It has since been updated in November 2023 to reflect new information that was reflected in the webinar "Gear Up For 2024 GST Reverse Charge And Next Steps For Business", hosted by Sage Asia.

To see the relevant changes, please click here.

Prior to 2020, consumers of services imported from overseas did not have to pay the Goods and Service Tax (GST) on those services. This meant that imported services held an unfair advantage over services produced locally, which became more apparent with the growing popularity of digital services such as e-Commerce marketplaces and streaming services.

To address this disparity, the Goods and Service Tax (Amendment) Bill was passed in November 2019 to apply the GST on imported services, and this went into effect on 1st January of this year. This was intended to ensure that all services consumed in Singapore are treated equally when it comes to GST treatment, whether produced locally or sources from overseas.

There are two ways that GST has been imposed on imported services. One of these, the Overseas Vendor Registration (OVR) regime for business to consumer (B2C) supplies of imported digital services, is designed to allow the Government to collect GST from vendors of overseas services for consumers such as electronic marketplaces, online subscription fees for software, and video streaming platforms.

Source: PCMag

On the other hand, if your business sources marketing, IT and management services from overseas, the Reverse Charge (RC) regime is applicable to you; as it taxes business-to-business (B2B) supplies of services imported by local GST-registered businesses such as yours.

Therefore, if your business uses imported services, read on to find how the new rules will affect you, and how your business can adapt to the RC regime with ease.

Is Your Business Subject To Reverse Charge?

If your business is considered a GST-registered person which is

- Not entitled to claim input tax in full, such as if your business

- makes substantial exempt supplies; or

- receive non-business receipts;

- Belongs to a GST group which is not entitled to claim input tax in full; or

- Is fully taxable, yet has elected to apply RC on all imported services

Then RC will apply, and your business will be termed an “RC Business”.

Some examples of businesses which are not entitled to full input tax claims include banks, insurance companies, mixed developers, GST-registered charities and voluntary welfare organisations.

Source: Grant Thornton

How Does Reverse Charge Work?

As the recipient of imported services, your business will have to account for GST on their value as though it is the supplier.

You will also be able to claim GST as your business’s input tax, subject to the usual input tax recovery rules.

What Kind Of Imported Services Will Be Subject To Reverse Charge?

Imported services that would be standard-rated if your RC business had sourced them from a local GST-registered business, and for the making of exempt supplies will be subject to RC.

This means that the following services are not subject to RC;

- Exempt services, such as financial services

- International services that would qualify for zero-rating, had they been made by a taxable person based locally

- Services provided by the government of a jurisdiction outside Singapore, if the services are of a nature that fall within the description of non-taxable government supplies under the Schedule to the GST (Non-Taxable Government Supplies) Order of the GST Act

- Services directly attributable to taxable supplies. This is not applicable if your RC business was prescribed a fixed or special input tax recovery formula, unless otherwise allowed by IRAS.

However, the above exclusions will not apply if you elect to apply RC on all services imported by your RC Business.

If your business consists of subsidiaries based in other countries, you should note that RC will apply if;

- Your local branch procures services from an overseas subsidiary, or

- Your local branch is a member of a GST group, and procures services from an overseas member within the same GST group.

That said, if any transactions between your local branch and overseas subsidiaries are related to cost allocation, you should also know that any portion related to salary, wages and interest (including proportionate mark-ups in accordance with transfer pricing policy) will be excluded from the value of transaction under RC.

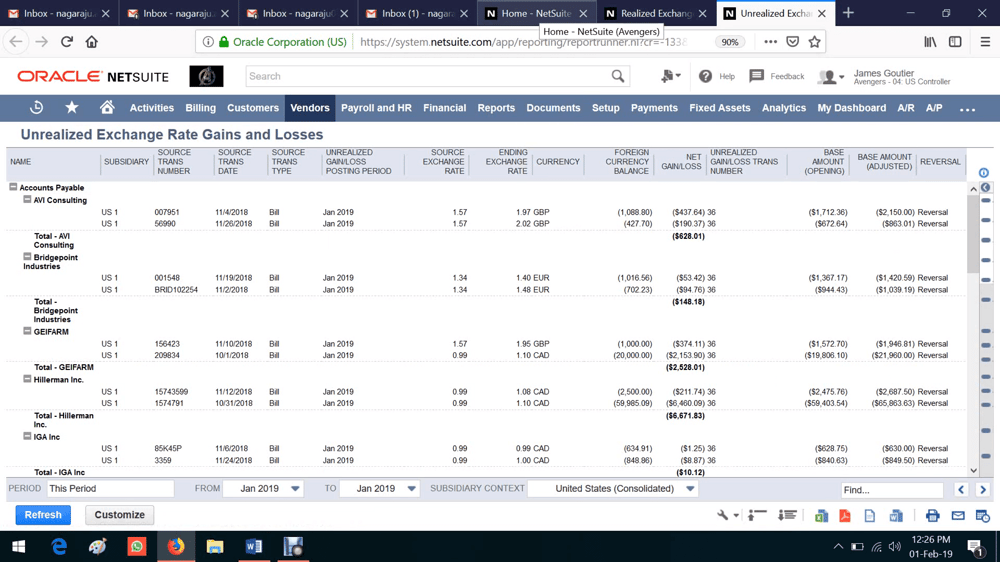

Overview of Oracle NetSuite's Financial Management. Source: AFON

A true cloud ERP software like Oracle’s NetSuite can be especially useful for your business in this regard. Because all of the data from your business and its subsidiaries are stored in a single database, NetSuite comes with built-in consolidation and intercompany elimination capabilities.

This means that you can update your financial management module with the new GST regulations, and RC will be reflected in all invoices generated by your subsidiaries from that point on, saving you a lot of time and effort.

Changes to Reverse Charge For Imported Services

On 21 November 2023, Sage Asia hosted a webinar, "Gear Up For 2024 GST Reverse Charge And Next Steps For Business", that covered some more of the more recent changes in the Reverse Charge regime.

Amongst these changes are those that pertain to digital and remote services imported by RC Businesses that are GST-registered in Singapore. Here are the details;

Before 1 January 2023

RC Businesses which procured digital services from GST-registered overseas vendors, and did not inform them that their business is GST-registered in SIngapore, will be charged GST on their purchase of said digital services.

They should contact their overseas supplier to obtain a refund of the GST that was wrongly charged, and not make an input tax claim.

Subsequently, the RC Business should account for GST on the value of the imported digital services, if they fall within the scope of the Reverse Charge regime.

From 1 January 2023 Onwards

Beginning from 1 January 2023, if the RC Business is not able to obtain a refund from their overseas supplier, they need not perform Reverse Charge on the imported digital services.

What Should You Do To Keep Your Business Compliant With The New GST Rules?

If you haven’t done so already, you can start by thinking about how and what ways the RC regime will affect your business. Here are some of the steps you may want to take;

- Identify your imported services and/or overseas vendors where RC will apply;

- Identify which of your transactions fall within the scope of RC;

- Find out whether you’re entitled to full input tax recovery, so you can avoid the liability of accounting for RC on your imported services

- Keep your finance function updated on the new rules and requirements;

- Update your business’s GST return preparation process and templates to account for the new RC regime.

- Ensure that the relevant tax codes for importer services have been installed on your accounting system, so you can easily track and account for RC on them.

- Consider automating the process of accounting for RC

ERP software can be especially useful in automating the account process to ease compliance with the RC regime. With updates to the GST-related modules in your ERP, you can generate GST Reports with ease and help your business meet the due dates for GST registration, even with the new requirements.

For example, if your business is using Microsoft Dynamics 365 Business Central, our very own GST Localization for Singapore extension for the ERP software can be updated with the changes that came with the Netflix tax in the GST Entries, as well as the GST Form 5 layout that comes with the extension.